Grid Signals

Grid signals are ideal for trading a trending or a sideways market and help to maximize the profit and minimize the risk. The Fxdatapanel grid trading signals contain four sets of trade recommendations. Each trade recommendation includes an entry-level and take-profit level, while all trades have a combined stop-loss. A successful grid trading strategy in financial markets is incredibly powerful for risk management. It is because the firepower remains with the trader to deploy according to the rapid changes in the market. The Fxdatapanel grid trading signals have a proven track record with nearly 80% success rate. The FXDatapanel trading signals are handy to build a no-loss grid trading strategy.

Grid Trading Signals For Multi-Asset Trading

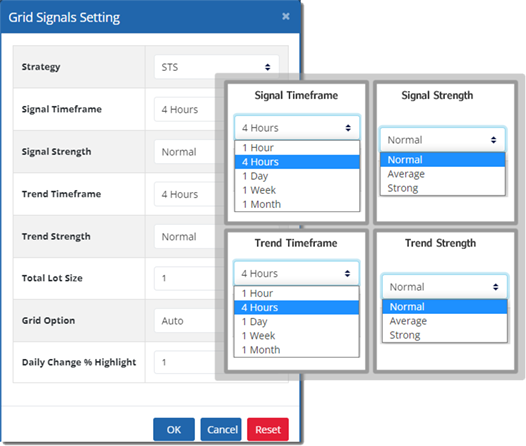

You can generate grid trading signals for Forex, indices, commodities, and cryptocurrencies. You can define options for generating grid trading signals, such as signal strategy, signal timeframe, signal strength level, and trend timeframe. The Fxdatapanel grid trading signal strategies include both the technical and fundamental aspects of the market. So every trading signal goes through a complete technical and fundamental examination.

Grid Trading Signals For Multiple Timeframes

You can generate trade signals from 1-hour to one-month timeframes. Additionally, you can also match the trade signals across multiple timeframes. This way, the platform will only generate the trade signal if it is available on both timeframes. Suppose you generate a trade signal on a 1-hour timeframe and set it to match the daily timeframe. In that case, the platform will only give you the trade signal if it's available on both timeframes. The platform will automatically perform multiple timeframe analyses and save you a lot of time.

Trade Signal Strength Level

In addition, you can also set the strength level of the trade signals. You can set average, normal, and strong signal strength levels. If you generate signals with an average strength level, you will have more trading signals as the platform will perform fewer checks to generate the trade signals. Likewise, for normal and strong signal strength levels, the paltform will perform additional checks to ensure a higher success rate.

Trade Signals Strategy With Risk Management

In Forex trading, risk management starts with a proper lot or position sizing. Using the FXDatapanel platform, you can generate grid trading signals by defining your lot size. For instance, if you enter one lot, the platform will strategically distribute one lot across all four trades. So, all you have to do is place the pending orders and wait for the execution. You can also do the position sizing in a pyramid or linear format. The linear option will distribute equal quantity in four trades. The pyramid option will allocate the smallest amount to the first order and gradually increase and allocate the remaining lot to the following three orders. Alternatively, you can set the grid option to auto, allowing the platform to distribute and allocate the trade quantity using its proprietary algorithm.

FXdatapanel platform will help you to build a profitable Forex grid trading strategy and sail smoothly in rough market conditions. We have also included a unique Forex Lot Size Calcatuor for calculating the position size with proper risk management. The lot size calculator uses instrument volatility along with your trading equity and provides position sizing for both grid and straight trading signals.